Small businesses account for almost half the economic activity in the United States, but starting, maintaining, and growing one isn’t easy – one in five, about 20 %, fail within the first year.

A new metric developed by actuarial science graduate students and faculty at UConn is shedding light on the U.S. states and territories where small businesses have the longest life expectancy, based on an analysis of data from the U.S. Bureau of Labor Statistics.

“If I was a small business owner, and I was deciding where I would start my business, or maybe in what business category, this would kind of give me a little bit of an insight,” says Jeyaraj (Jay) Vadiveloo, a professor in residence with the Department of Mathematics in the UConn College of Liberal Arts and Sciences and director of the Janet and Mark L. Goldenson Center for Actuarial Research at UConn.

‘Maybe go to North Dakota?’

Small businesses are defined by the federal Small Business Administration as those with 500 or fewer employees.

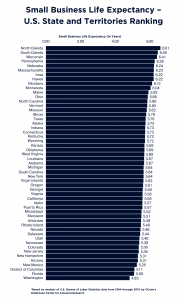

The new Small Business Life Expectancy, or SBLE, metric designed by Vadiveloo and his students looked at small business survival rates in 53 U.S. states and territories for 12 durations between 1994 and 2010, using Bureau of Labor Statistics data published in 2022.

In their analysis, the team found that small businesses in North Dakota had the longest life expectancy at an average of 6.61 years – the states of South Dakota, Wisconsin, Pennsylvania, and Nebraska rounded out the top five.

Connecticut ranked in the top half of the states and territories at 20, with an average life expectancy of 5.73 years.

The state of Washington came in last at 4.83 years.

Vadiveloo is quick to point out that, just like individual life expectancy, a given business may do better or worse than the metric predicts, regardless of its location.

“If you look at a particular small business in North Dakota, they may or may not have the kind of life expectancy we’re showing in this,” he says. “They may be more or less.”

The team also looked at the first-year failure rates of small businesses and found that the states with the top five lowest average first-year failure rates during the same durations were Massachusetts, Wisconsin, Minnesota, Iowa, and Pennsylvania. Those with the top five highest average first-year failure rates were Washington, the District of Columbia, New Mexico, New Hampshire, and Rhode Island.

The small business categories with the highest life expectancy were management, agriculture, and utility. The lowest life expectancy categories were information, construction, and transportation and warehousing.

Making It Easier for Small Businesses

This new macro analysis, first shared in the March/April edition of Contingencies magazine, can give entrepreneurs and business owners some important insight into survival and failure trends in their state, says Vadiveloo.

“The nice thing about a macro analysis is that it is a single number,” he says. “I can very quickly say that North Dakota was number one, and the shortest life expectancy was Washington state. The way we’re measuring it, it’s not like the gaps are huge – North Dakota’s average life expectancy is about 6.6, and Washington is 4.8 – but one year of difference in life expectancy can mean a lot.”

The next step, he says, is to build out a qualitative portion of the SBLE metric that asks individual small business owners to characterize certain aspects of their business – things like retention and turnover, risk management, succession and contingency plans, amongst other factors – to help determine how their individual business might do better or worse than the average.

“Then, I can tell the small business, ‘You belong to a business category with a small business life expectancy of five, but based on your responses, you are closer to a six,’” he explains. “That is very helpful.”

The work is an expansion of Vadiveloo’s ongoing interest in analysis related to life expectancy. The Goldenson Center at UConn previously launched an online calculator that calculates an individual person’s healthy life expectancy. The Healthy Life Expectancy Calculator proved so popular that the app crashed from an overload of volume when first launched.

It’s also part of continuing efforts to provide information and services to small businesses in Connecticut and beyond – last year, Vadiveloo and a team of undergraduate actuarial science students launched a program that pairs the students with small businesses in Connecticut in order to provide free risk management analysis.

UConn graduate students Jizhou Chen, Abigail Baidoo, Gayeon Lyou, Shuyao Cai, and Chung Yun, and Visiting Assistant Professor Zhiguo Wang ’22 Ph.D. contributed to the SBLE’s development.

The Janet & Mark L. Goldenson Center for Actuarial Research at UConn is a leading think tank for applied actuarial research. For more information about the center, please visit goldensoncenter.uconn.edu.